The Value of Research by Bryan T. Kelly, Alexander.

Additional materials for Asset Pricing, lecture notes, new chapters, and the online class are now moved to their own page here, or via the Asset Pricing link at left. Financial Markets and the Real Economy Volume 18 of the International Library of Critical Writings in Financial Economics, John H. Cochrane Ed., London: Edward Elgar. March 2006.

The third issue we looked at was how intermediaries help institutional investors identify good asset managers and the impact they have on competition between asset managers. In the institutional market we see a wide range of investors. There are a number of large, sophisticated institutional investors who are able to negotiate good deals with.

This paper investigates the effect of active institutional investor networks on firm value. Using data on US institutional investors, we document that block-holdings from more central, active institutional investors enhance firm value more than those held by other investors. Our findings are consistent with the view that central institutional.

Joakim Westerholm’s research interests are broad and span several sub-fields in financial economics. In Asset Pricing his research investigates the pricing impact of trading by insiders, mutual funds and institutional investors. His work showing that insider trades can be better understood through the trading decisions of underaged accounts.

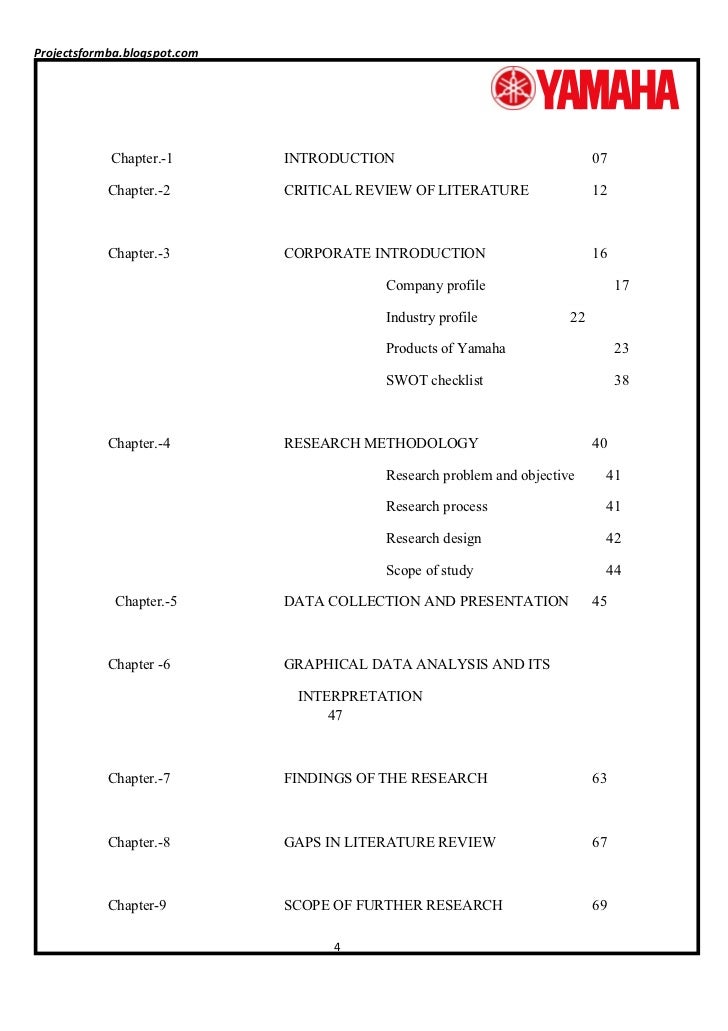

Introduction of corporate governance has a publicity images or snob value where the companies with corporate governance are treated by investors and the general public as prosperous and forward looking. Corporate governance helps institutional investors. The autocratic ways of working by top brass is removed. Corporate governance creates a new.

The Journal of Investment Strategies is dedicated to the rigorous treatment of modern investment strategies; going well beyond the “classical” approaches in both its subject instruments and methodologies. In providing a balanced representation of academic, buy-side and sell-side research, the Journal promotes the cross-pollination of ideas.

Other posts on the site.

Adam Smith Asset Pricing Conference (2015) Western Finance Association (2014) American Finance Association meetings (2014) Western Finance Association meetings (2013) Financial Intermediation Research Society Conference (2013) SFS Cavalcade (2013) FSU Conference (2013) GSU Finance Workshop on Institutional Investors (2013).

Prior to joining Bank of America Merrill Lynch Daniel was an Associate Professor of Finance at the Athens University of Economics and Business and had worked closely for over 10 years with institutional investors, investments banks and asset management organizations in Europe and in the United States in areas covering quantitative equity.

Theories in contrast to traditional asset pricing posit that the role of investor sentiment in asset pricing is significant (De Long et al., 1990a, De Long et al., 1990b, Lee et al., 1991, Barberis et al., 1998). Notably, the model of De Long et al. (1990a) emphasizes on the role of noise traders in the equilibrium of assets prices. The model.

His research interests are in the regulation of banks and financial institutions, corporate finance, valuation of corporate debt, and asset pricing with a focus on the effects of cash management and liquidity risk. He has published articles in the Journal of Finance, Journal of Financial Economics, Review of Financial Studies, Journal of.

Financial Decisions and Markets: A Course in Asset Pricing, Princeton University Press, 2018. The Squam Lake Report: Fixing the Financial System, with the Squam Lake Group (Kenneth French, Chair), Princeton University Press, 2010. Strategic Asset Allocation: Portfolio Choice for Long-Term Investors, with Luis M. Viceira, Clarendon.

According to rational expectation models, uninformed or liquidity trading make market price volatility rise. This paper sets out to analyse the impact of herding, which may be interpreted as one of the components of uninformed trading, on the volatility of the Spanish stock market. Herding is examined at the intraday level, considered the most reliable sampling frequency for detecting this.

Risk Systems That Read augments Northfield’s already comprehensive models to deliver a more accurate and detailed understanding of risk. It offers the statistical stability of a long-term model forecast enhanced by rapid adaptation to changing market conditions, over a very broad range of asset coverage.